Brief by Shorts91 Newsdesk / 09:54am on 05 Dec 2025,Friday Business

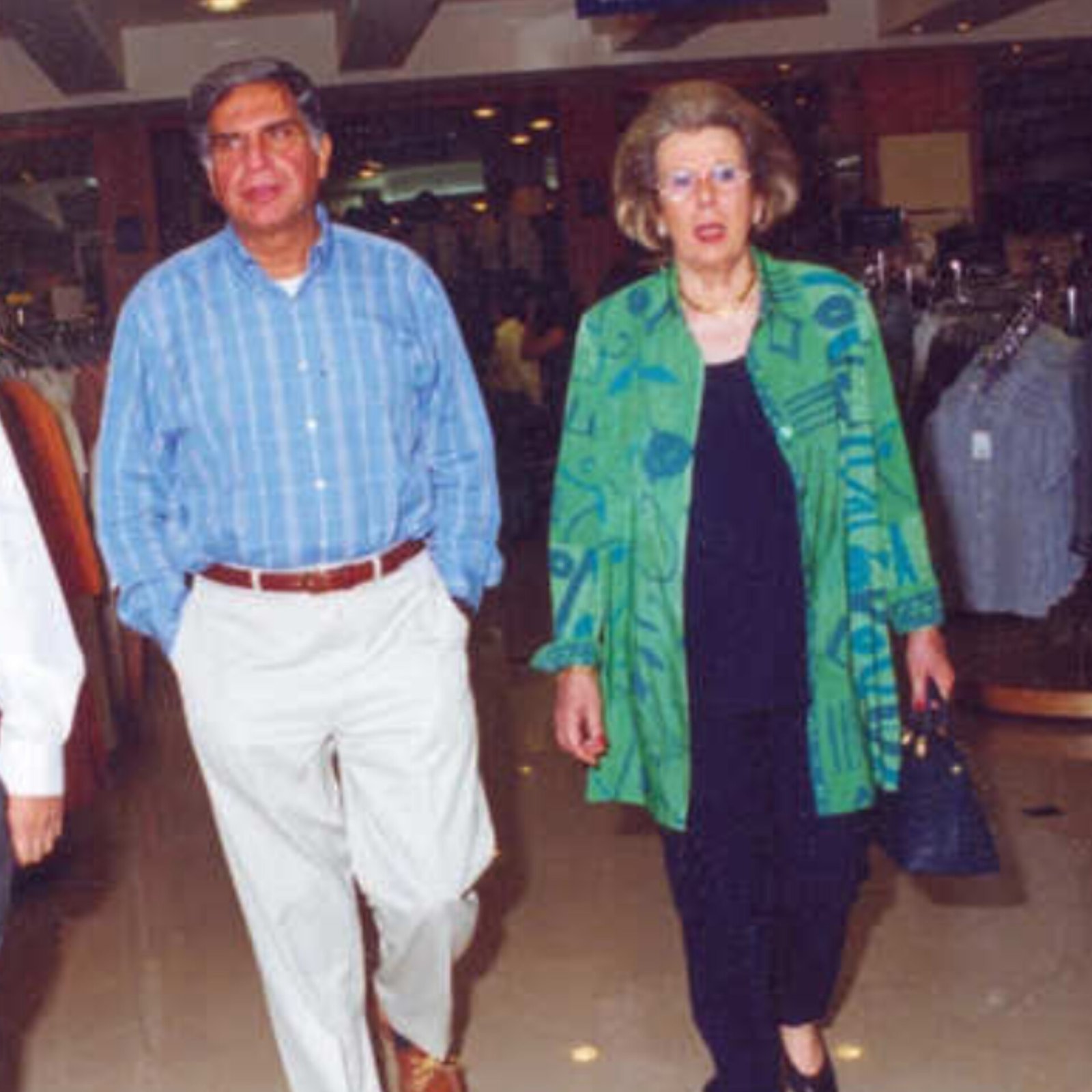

Simone Tata, step-mother of Ratan Tata and a major force in India’s beauty and retail sectors, passed away at 95 in Mumbai. She had been battling Parkinson’s symptoms and was airlifted from Dubai earlier this year for treatment. Born in Geneva, she moved to India after marrying Naval Tata in 1955. Simone helped build Lakmé into a leading Indian cosmetics brand and later founded Trent Ltd., which launched Westside. She led both companies for decades, shaping India’s consumer market. After retiring in 2006, she stayed away from public life and was last seen at Ratan Tata’s funeral in 2024.

Brief by Shorts91 Newsdesk / 06:09am on 03 Dec 2025,Wednesday Business

The rupee fell below the 90-per-dollar mark for the first time on Wednesday, hitting 90.11 in early trade. The drop shocked traders as the currency faced strong global and domestic pressure. Foreign investors have been pulling money out of India, and the strong US dollar has added more strain. Delays in the India–US trade deal and record-high commodity prices have also hurt sentiment. Experts say muted RBI intervention led to a faster fall. Markets now wait for the RBI policy update on Friday. Analysts warn the rupee may stay volatile and could fall further if global cues remain weak. (PC: India Today)

Brief by Shorts91 Newsdesk / 04:51pm on 02 Dec 2025,Tuesday Business

OpenAI CEO Sam Altman has declared a "code red" for ChatGPT as competitors Google and Anthropic rapidly gain ground in the AI race. In an internal memo, Altman announced delays to several projects including advertising plans, shopping and health agents, and the personal assistant "Pulse." The company will prioritize making ChatGPT faster, more reliable, and accurate. Altman established daily team calls and encouraged cross-team movement to accelerate development. Google's momentum has intensified, with its Gemini 3 model outperforming competitors and its infrastructure advantage enabling efficient AI deployment across Search, YouTube, and Gmail. OpenAI faces pressure to generate $200 billion annually by 2030, while Google already earns $120 billion yearly.(PC: Dubai Immo)

Brief by Shorts91 Newsdesk / 08:40am on 02 Dec 2025,Tuesday Business

Apple refuses to comply with India's confidential order requiring smartphone manufacturers to preload the government's Sanchar Saathi cybersecurity app within 90 days. The company will inform New Delhi it doesn't follow such mandates globally due to privacy and security concerns for its iOS ecosystem. The app, designed to track stolen phones and prevent misuse, must remain non-disableable and be pushed via software updates to existing devices. India's telecom ministry defends the measure as combating "serious endangerment" of cybersecurity, but opposition parties and privacy advocates criticize it as surveillance overreach targeting India's 730 million smartphones. Samsung and Xiaomi are reviewing the order, while Apple maintains it "can't do this. Period." (PC: Smartpix)

Brief by Shorts91 Newsdesk / 02:47pm on 01 Dec 2025,Monday Business

H-1B visa approvals for India's top seven IT companies plummeted to a 10-year low in fiscal year 2025, with only 4,573 petitions approved for initial employment, a 70% decline since 2015 and 37% drop from 2024. TCS remained the sole Indian firm among top five employers, securing 846 initial and 5,293 continuing employment approvals, though facing increased rejection rates. American tech giants Amazon, Meta, Microsoft, and Google dominated initial approvals, hiring foreign talent for AI development projects after investing billions in artificial intelligence. The shift reflects Indian IT firms delivering services with fewer H-1B visas while US companies aggressively recruit foreign-born graduates to build domestic AI capabilities, fundamentally transforming skilled immigration patterns. (PC: Bloomberg & India Today)

Brief by Shorts91 Newsdesk / 01:13pm on 28 Nov 2025,Friday Business

India's economy surged ahead with 8.2% GDP growth in Q2 FY2025-26, the highest in six quarters, significantly outpacing last year's 5.6% and Q1's 7.8%. The National Statistics Office data reveals manufacturing expanded 9.1%, construction grew 7.2%, while services led with 9.2% growth, particularly financial and professional services at 10.2%. Private consumption strengthened to 7.9% from 6.4% year-on-year, indicating robust demand despite US tariff pressures. However, agriculture lagged at 3.5% growth. GDP at constant prices reached Rs 48.63 lakh crore, with nominal GDP rising 8.7%. The first half delivered 8% overall growth versus 6.1% previously, reinforcing India's position as the world's fastest-growing major economy heading into FY26's second half. (PC: India Today)

Brief by Shorts91 Newsdesk / 04:15am on 27 Nov 2025,Thursday Business

Prime Minister Narendra Modi shared a lighthearted moment with Safran Chairman Ross McInnes during the inauguration of the company's Maintenance, Repair and Overhaul facility in Hyderabad. McInnes jokingly said, "I was born in India. So I'm 'Made in India' too," making PM Modi laugh. The MRO facility will service LEAP engines for A320 and B737 aircraft, while another facility for M88 engines powering Rafale jets will also be established. Both facilities, operational by 2026, will boost India's indigenous aviation capabilities. Modi highlighted India as a "trusted partner" with rapid growth, stable government, and vast talent pool. Safran has operated in India for 70+ years.

Brief by Shorts91 Newsdesk / 12:11pm on 16 Nov 2025,Sunday Business

Adani Group will invest ₹63,000 crore (~$7.17 billion) in Assam to significantly upgrade the state’s power infrastructure. The investment includes a 3,200 MW ultra-supercritical coal-based power plant costing ₹48,000 crore, expected to begin phased operations from December 2030. Additionally, Adani Green Energy will invest ₹15,000 crore in two pumped-storage hydro projects with a combined capacity of 2,700 MW. These strategic projects aim to improve energy security, support industrial expansion, and create extensive job opportunities in Assam, marking one of the state’s largest private infrastructure investments. (PC: Reuters)

Brief by Shorts91 Newsdesk / 05:21pm on 07 Nov 2025,Friday Business

Elon Musk secured a record-breaking $1 trillion Tesla pay package after 75% of shareholders voted in favor at the Texas annual meeting, bringing him closer to becoming the world's first trillionaire. Currently worth $491 billion, Musk celebrated by dancing with Tesla's humanoid Optimus robot on stage. To cash in, he must grow Tesla's market value from $1.4 trillion to $8.5 trillion, sell 20 million cars, and deploy a million robotaxis and robots over the next decade. Despite opposition from Norway's sovereign wealth fund and CalPERS citing excessive compensation, supporters view it as betting on Musk's vision to transform Tesla into an AI and robotics empire.

Brief by Shorts91 Newsdesk / 04:49am on 07 Nov 2025,Friday Business

Tesla shareholders approved Elon Musk's landmark $1 trillion pay package at the company's Austin annual meeting on Thursday, with over 75% investor backing. The compensation is tied to ambitious performance milestones, including boosting Tesla's market value from $1.5 trillion to $8.5 trillion. Musk celebrated by dancing onstage with Tesla's humanoid robot, Optimus, calling it "the beginning of a new chapter." The deal grants Musk an additional 12% stake if Tesla achieves targets including delivering 20 million vehicles annually, deploying 1 million robotaxis, selling 1 million humanoid robots, and generating $400 billion annual profit. Despite opposition from institutional investors like Norway's sovereign wealth fund citing excessive executive compensation, Tesla shares rose 1% post-announcement.